This is the second article in our 12-part Finance Blog Series, From Zero to Confident.

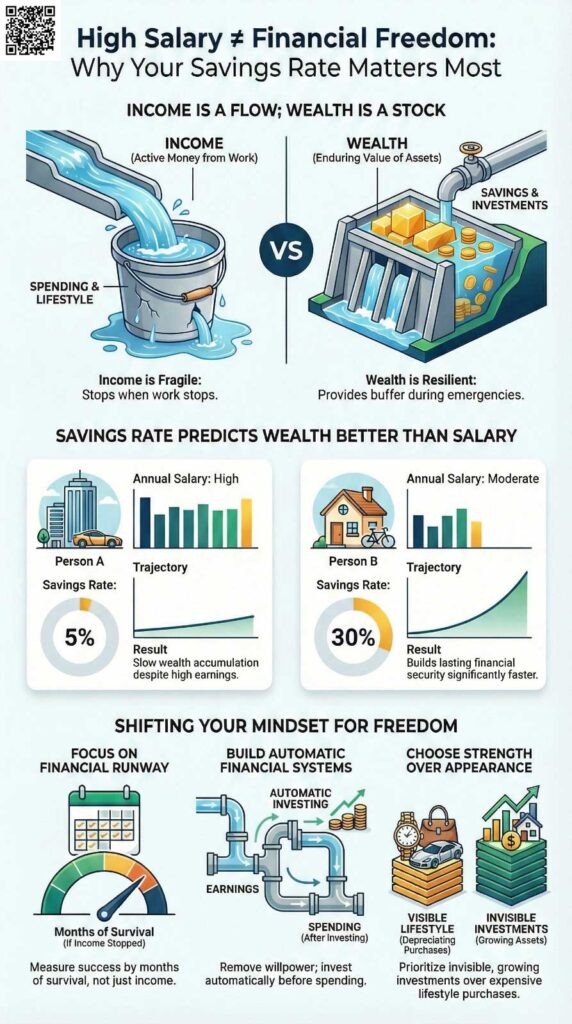

- Income is a flow (money earned regularly); wealth is a stock (assets owned minus liabilities).

- High income often fails to create wealth due to lifestyle inflation and increased debt commitments.

- The savings rate—the percentage of income invested—is a stronger predictor of wealth than the salary level.

- Wealth provides resilience, compounding returns, and financial freedom; income provides temporary comfort.

- Building wealth requires shifting focus from ‘how much I earn’ to ‘how long my money lasts’ and implementing automatic financial systems.

Income vs Wealth:

Many people believe earning a high salary is the quickest way to become rich. A large income promises comfort, security, and more choices in life. Yet, many high-income earners still experience financial stress. Despite earning well, they struggle to build savings and remain unprepared for unexpected expenses. This common situation highlights a critical financial truth: income and wealth are fundamentally different concepts.

You can earn a substantial salary and still struggle financially. Conversely, some individuals with moderate incomes quietly build lasting financial security. Understanding the difference between income and wealth is vital. It is one of the most important financial lessons for long-term success.

This article explains why a high salary is insufficient for building wealth. It details the essential steps needed to achieve true financial freedom.

What is the Difference Between Income and Wealth?

Income and wealth are often confused. They serve different purposes in your financial life. Think of income as a flow and wealth as a stock.

What Is Income?

Income is the money you receive regularly. It comes from work or business activities. Examples include:

- Salary or wages from your job.

- Bonuses or commissions.

- Earnings from a side hustle or freelance work.

Income is active. You must keep working to receive it. If the work stops, the income usually stops immediately.

What Is Wealth?

Wealth is the value of everything you own (assets) minus everything you owe (liabilities). It is also called net worth. Wealth includes:

- Cash savings and bank deposits.

- Investments like stocks, bonds, or unit trusts.

- Assets such as property (like an HDB flat) or retirement accounts.

Wealth is passive and enduring. It continues to exist and grow without your daily effort. Wealth provides security and generates future income.

Why High Income Does Not Guarantee Wealth

A high salary provides a strong foundation. However, it faces specific challenges that prevent wealth accumulation.

1. Lifestyle Inflation Reduces Savings

As income rises, spending often increases at the same pace. This is called lifestyle inflation. People buy bigger homes, better cars, or travel more frequently. Premium conveniences become the new normal.

Despite earning more, many high earners save no more than before. The higher income simply supports a more expensive lifestyle. It does not create wealth. Wealth is built on what you keep, not what you earn.

2. Increased Access to Debt

A higher income makes it easier to qualify for large loans. This includes large mortgages or expensive car loans. High earners often take on significant debt commitments. Debt reduces your net worth. It limits your ability to invest and build assets. The size of your debt can outweigh the size of your salary.

3. Income is Fragile; Wealth is Resilient

Income depends on external factors. These include employment status, health, and economic conditions. If your job ends, your income stops. This makes income fragile.

Wealth is resilient. It provides a financial buffer during emergencies. It generates returns through compounding interest. Wealth creates options and true financial freedom. It is a safety net when income disappears.

The Key Factor: Savings Rate Over Salary Size

The percentage of your income that you save and invest – your savings rate – is the most important factor. It predicts wealth better than your salary level.

Consider two people. Person A earns a high salary but saves 5%. Person B earns a moderate salary but saves 30%. Over time, Person B will accumulate wealth much faster than Person A. This is because consistency and discipline matter more than the starting amount.

The Power of Compounding

Wealth grows through compounding. Invested money earns returns. Those returns are reinvested and earn their own returns. This creates exponential growth over decades. Income alone cannot replicate this effect. Starting to invest early is crucial for harnessing the power of compounding.

Shifting Mindsets: Turning Income into Lasting Wealth

Building wealth requires specific mindset changes. These shifts separate high earners who stay financially stuck from those who achieve lasting freedom.

1. Focus on Financial Runway, Not Monthly Income

Stop measuring success by your monthly salary. Start measuring success by your financial runway. The runway is how long you could live comfortably if your income suddenly stopped.

A high earner who spends everything they make has a financial runway of zero. In contrast, someone with savings and investments may have months or even years of security. Ask yourself: “How many months of freedom does my money buy?”

2. Prioritise Financial Strength Over Appearance

Do not confuse visible spending with financial health. True wealth is often invisible. It is money quietly invested. It is debt intentionally avoided. People who look rich often have high cash flow but low net worth. Choose financial strength over financial appearance.

3. Build Automatic Financial Systems

Relying on willpower to save is unreliable. Wealth builders focus on systems that work automatically. Implement automatic transfers to your savings and investment accounts. Save a fixed percentage of your income before spending any of it. These simple rules remove the need for daily decision-making. Systems build wealth even when motivation fades.

4. Redefine Financial Risk

Many people fear investment risk. They ignore lifestyle risk. Lifestyle risk includes high fixed expenses and heavy debt commitments. Dependence on a single source of income is also a risk. Avoiding investing entirely can be the riskiest decision of all. Risk means having no buffer, no flexibility, and no margin for error.

5. Seek Freedom, Not Speed

Chasing fast money often leads to poor decisions and fragile finances. Wealth accumulation is a marathon, not a sprint. It grows slower but stronger when the goal is freedom. Freedom means having control over your time and choices. It means making decisions based on your values, not financial pressure.

Action Plan: Start Your Personal Finance Journey Today

1. Calculate Your Net Worth

Everything you own. Everything you owe

2. Focus on Growing Assets

Prioritize:

- Emergency savings

- Long-term investments

- Skills that increase future income

3. Reduce High-Interest Debt

Paying off debt gives you a guaranteed return — often higher than investing.

4. Avoid Lifestyle Inflation

Earning more should increase savings/invesment, not just spending.

5. Track Wealth, Not Just Income

Review your net worth regularly. Progress builds motivation.

Conclusion: Income is a Tool, Wealth is the Goal

A high salary is a powerful tool. It provides the resources needed to build wealth. However, it is not the final destination. Without discipline, intentional systems, and long-term thinking, income can be spent as quickly as it arrives.

Wealth is built intentionally. This involves saving consistently, investing wisely, and resisting lifestyle inflation. Remember this key distinction:

Income pays bills. Wealth creates freedom.

Focus on converting your income flow into a resilient stock of assets. This is the path to true and lasting financial security.

We hope this article has helped you understand why a high salary alone does not create financial freedom, and why how you manage money matters more than how much you earn.

In the next article, we’ll explore How Inflation Quietly Steals Your Money Every Year, and explain why doing nothing with your money can be more costly than making the wrong move.