- Personal finance is not about income; it is about managing what you have to reduce stress and build security.

- Ignoring personal finance creates significant opportunity costs, potentially costing hundreds of thousands of dollars over a lifetime due to lost compound interest and unnecessary fees.

- Financial literacy provides the freedom to make intentional life choices, such as quitting a toxic job or pursuing passion projects, by creating a financial buffer.

- Building wealth relies on creating automated systems (like automatic savings transfers) rather than relying solely on willpower.

- Start your financial journey today by calculating your net worth, building an emergency fund, and aggressively tackling high-interest debt.

This is the first article in our 12-part Finance Blog Series, From Zero to Confident.

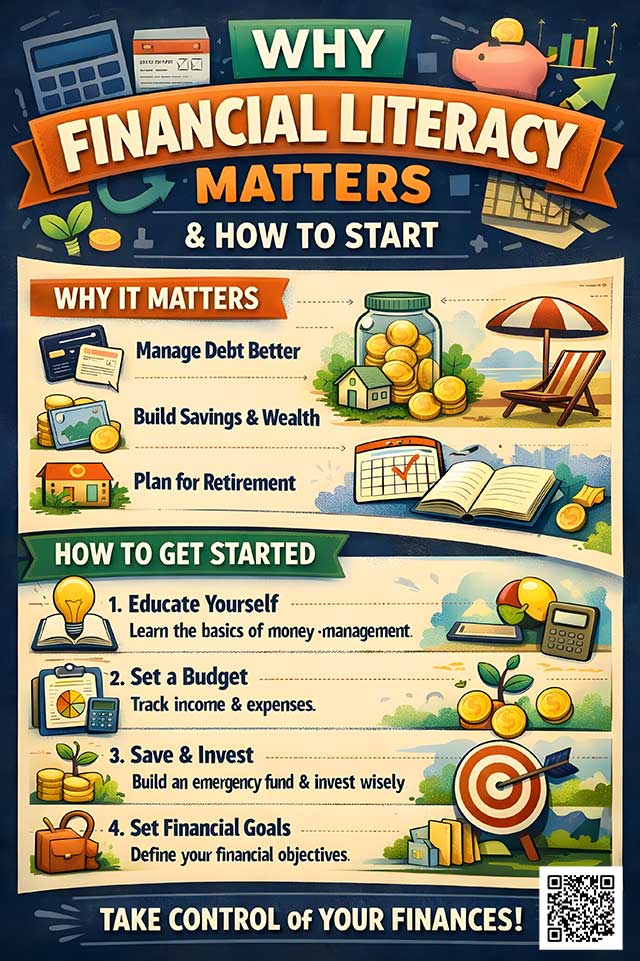

We start by answering a simple but important question: Why does financial literacy matter? You’ll also learn how to take your very first steps toward managing money with confidence, even if you’re starting from zero.

Have you ever wondered why some people who earn a decent salary still seem stressed about money? And why others, earning less, appear completely relaxed? The secret is simple: it is not about how much money you earn, but how well you manage the money you have. This skill is called personal finance.

Most of us spend more time planning our next holiday, or buying the next bag, than planning our financial future. We work hard, perhaps climbing the corporate ladder, yet we often wonder where our money went at the end of the month. Does this sound familiar?

Personal finance is more than just numbers in a bank account. It is about designing a life where your money works hard for you. Whether you are a student, a young professional living in an HDB flat, or approaching retirement, understanding personal finance is the most important life skill that school rarely teaches you. In Singapore’s economy, where the cost of living is always rising, this skill is now essential.

The High Cost of Ignoring Personal Finance

What happens when you ignore your personal finances? The effects go far beyond your wallet.

Financial Stress Affects Your Whole Life

Money worries do not stay separate; they affect every part of your life. Studies show that financial stress is a leading cause of anxiety for working adults. When you constantly worry about making ends meet, it impacts:

- Your Health: Chronic stress can cause sleep problems and weaken your immunity.

- Your Relationships: Money disagreements are a top reason for relationship problems.

- Your Career: Financial anxiety reduces your focus and productivity at work.

The good news? Most financial stress is preventable. All it takes is basic money management knowledge.

The Opportunity Cost of Waiting

Every day you delay learning about personal finance, you are losing money. This is called ‘opportunity cost’—the benefit you miss out on.

Think about the power of compound interest. A 25-year-old in Singaporean who invests just S$500 monthly could have over S$1.2 million by age 65. If they wait until age 35 to start, that number drops significantly. That difference, often hundreds of thousands of dollars, is the cost of waiting just 10 years.

This principle applies to many areas:

- Not comparing insurance policies costs you hundreds annually.

- Ignoring high credit card interest rates creates thousands in unnecessary debt.

- Keeping your savings in a low-interest account means inflation eats away at your money.

The cost of not knowing is not just what you spend today. It is what you could have built for your future.

Why Financial Literacy is Not Taught in School

Why do so many smart, hardworking people struggle with money? Because our education system prepares us for exams, but not always for life.

The Financial Education Gap

You can graduate with honours yet not know how to:

- Create a realistic budget that works for your lifestyle.

- Choose between different investment options like unit trusts, ETFs, stocks, SSB, Tbills and etc.

- Plan effectively how much money you need for your retirement.

- Protect yourslef with the right insurance coverage.

This is not your fault. Financial literacy is simply not prioritised. This gap leads millions of people to make costly financial mistakes.

The Danger of the “I’ll Start Later” Trap

Many people believe they will worry about money only when they are older and earning more. This mindset is devastating because:

- Time is Your Biggest Asset: Compound interest needs time to work its magic. Starting early with small amounts is much better than starting late with large amounts.

- Habits Form Early: Your spending habits today become your financial personality tomorrow. Waiting means you miss the chance to build discipline.

- Life Gets More Expensive: Promotions often lead to ‘lifestyle inflation’—a bigger car, a nicer flat, more expenses. Without good habits, more income rarely solves money problems.

How Personal Finance Delivers True Freedom

Money itself does not buy happiness, but financial security buys choices. And choices create happiness.

Freedom to Live Intentionally

With solid personal finance, you gain the freedom to make life choices, not just react to circumstances:

- You can quit a toxic job without worrying about next month’s rent or HDB mortgage payment.

- You can take a sabbatical to travel or study.

- You can start that business you have always dreamed about.

- You can help family members during emergencies without sacrificing your own security.

Personal finance is about creating a buffer between you and financial desperation. This allows you to live intentionally.

Freedom from Anxiety and Worry

Imagine the peace of mind that comes from being prepared:

- Unexpected medical bills? Your emergency fund covers it.

- Car breaks down? Annoying, but manageable.

- Economic downturn? Lost of job but your diversified investments provide protection.

Proper financial planning creates a buffer against life’s surprises. The peace of mind that comes from knowing you are financially prepared is truly priceless. You sleep better, stress less, and enjoy the present more.

Freedom to Build Generational Wealth

When you master money management, you do not just change your life; you change your family’s future. You can:

- Help your children avoid student debt.

- Support aging parents without compromising your own retirement.

- Break cycles of financial struggle that may have affected your family for generations.

Financial literacy is one of the most valuable gifts you can pass down. Your children learn about money by watching you. Make sure they are learning lessons that build wealth, not struggle.

Building Wealth Through Systems, Not Willpower

Successful people know that you cannot rely on willpower alone for financial success. Instead, they build automated systems.

The Power of Small, Repeated Choices

You may have heard about the ‘daily latte effect’. It is not really about the coffee. It is about understanding that small, repeated choices create massive long-term outcomes.

For example, that S$6 daily coffee costs over S$2,190 annually. Invested at 7% over 30 years, that small amount could have grown to over S$200,000. The point is awareness. This applies to:

- Subscription services you forgot about.

- Interest paid on credit card balances.

- Fees on investment accounts.

Automate Your Success

When your finances run on systems, you remove emotion and forgetfulness. The money moves before you have a chance to spend it. Wealth builds while you sleep.

Here are key systems to set up:

- Automatic Savings: Set up a standing instruction to transfer money to your savings account immediately after payday.

- Automated Investing: Schedule monthly contributions to your investment accounts.

- Bill Payments: Put all recurring bills on autopay to avoid late fees.

Action Plan: Start Your Personal Finance Journey Today

You do not need to transform everything overnight. Start with these practical, simple steps.

1. Calculate Your Real Financial Picture (Net Worth)

Spend 30 minutes listing:

- All income sources.

- Every monthly expense (fixed and variable).

- All debts with their interest rates.

- Current savings and investments.

Why it matters: You cannot improve what you do not measure. This awareness alone changes behaviour. Use a simple spreadsheet or a free budgeting app.

2. Build Your Emergency Fund Foundation

- Open a separate, high-yield savings account. Set up automatic monthly transfers. Start with a goal of S$1,000, then work towards 3 to 6 months of your monthly expenses.

- An emergency fund is the difference between a crisis and an inconvenience. It stops you from going into debt when life happens. Even S$50 a month adds up quickly.

3. Eliminate High-Interest Debt Strategically

- List all debts by interest rate. Commit extra payments to the highest-rate debt first (the debt avalanche method). Maintain minimum payments on the others.

- Credit card debt (often 18–24% interest) is financial quicksand. Every dollar you pay towards this debt gives you an immediate, guaranteed return—better than most investments.

4. Start Investing—Even With Small Amounts

Open a low-cost investment account. Set up automatic monthly contributions. Start with whatever you can afford—S$50 or S$100 matters. The biggest investing mistake is waiting to start. Time in the market beats timing the market, every single time. Beginner investors can use low-cost index funds or robo-advisors.

5. Educate Yourself Continuously

Commit to learning one new financial concept each week. Read personal finance books. Follow reputable finance content creators. Financial literacy is a lifelong journey. Continuous learning keeps you adaptable and informed as markets and laws evolve.

Conclusion: Your Financial Future Starts Now

Personal finance matters because your money represents your time, your energy, and your potential. Every hour you work is a piece of your life. Personal finance ensures those hours count towards building something meaningful.

You do not need to be a financial genius. You just need to start making intentional, informed decisions about your money today. The perfect time to start was ten years ago. The second-best time is right now.

We hope this article has helped you understand why financial literacy is important and how you can start working on it today.

In our next article, we’ll explore Income vs Wealth: Why a High Salary Doesn’t Make You Rich, and break down one of the most common money misconceptions.