In this article, I’ll show you a clever strategy to use one salary to credit into three different local banks—DBS, UOB, and OCBC—to earn higher interest rates. This method works for everyone, but it’s particularly effective if your default salary crediting account is with DBS and you’re not earning the maximum interest rate of 3% or above.

DBS Bank

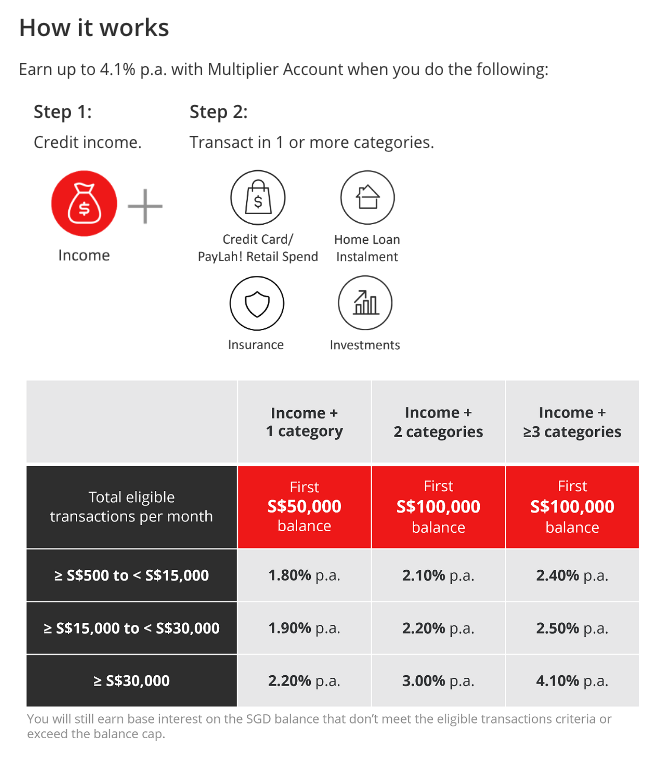

From the image below, DBS offers a maximum interest rate of 4.10%, depending on the number of transactions you perform per month and the categories you fulfill (Credit Card/PayLah! retail spending, Home Loan, Insurance, and Investments).

My approach

I use DBS to credit my salary and since I only meet one category with PayLah and Credit Card usage, the interest rate I get is about 1.80%. To boost my returns, I typically invest $5,000 in Treasury Bills (T-Bills), which have offered rates above 3.5% in recent months—almost double what DBS offers. I’ve found $5,000 to be a safe figure, as any amount above this often gets rejected and returned the balance.

UOB Bank

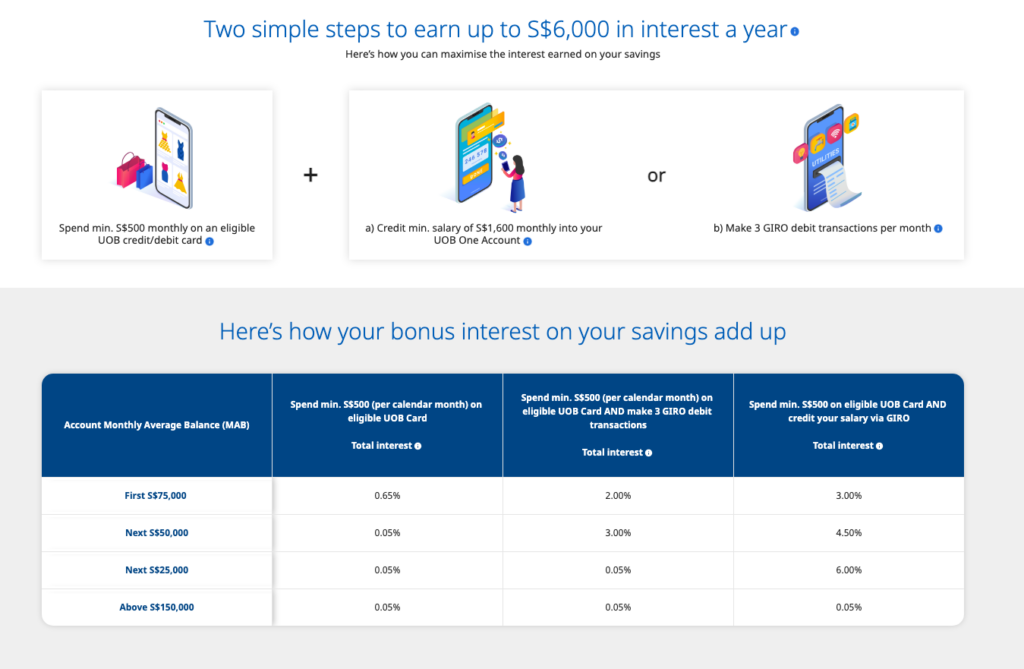

With UOB, you can earn up to 6% interest easily by completing just two actions: spending a minimum of S$500 monthly on an eligible UOB credit/debit card and crediting a minimum salary of S$1,600 monthly into your UOB One Account. The effective interest rate is 4% for balances up to S$150,000, with anything above earning just 0.05%.

My approach

My primary account is the UOB One Account. I ensure I meet the spending requirement by charging my insurance, mobile, internet, transport, and grocery expenses. The challenge is how to credit the S$1,600 salary into UOB One Account since it’s already credited my salary to DBS.

Here’s the trick: each month, log in to DBS internet banking and transfer S$2,000 to UOB account via iFAST, under “purpose of transfer” select it as a salary payment. UOB will recognizes this as a valid salary credit, and you can earn around S$500 in interest each month.

Once my UOB account balance exceeds S$150,000, I transfer the excess back to DBS to earn up to 1.8% interest, as anything above S$150,000 in UOB only earns a paltry 0.05%. (meaning if I have S$151,000, the extra S$1,000 will only earn 0.05% interest)

OCBC Bank (New Update)

OCBC recently updated its salary credit rules. Now, you can credit your salary through GIRO, FAST, or PayNow and earn an effective interest rate (EIR) of up to 2.5% per year. Additionally, by increasing your average daily balance by at least S$500 monthly, you can earn a maximum EIR of 4.05% per year.

If you fulfill more categories, you can earn even higher interest.

For maximum EIR illustration purposes for your first S$100,000:

- Salary + Save: You will earn a maximum EIR of 4.05% a year.

- Salary + Save + Spend: You will earn a maximum EIR of 4.65% a year.

- Salary + Save + Spend + Insure / Invest: You will earn a maximum EIR of 6.15% a year.

- Salary + Save + Spend + Insure + Invest: You will earn a maximum EIR of 7.65% a year.

My approach

After completing my UOB transactions, I will transfer S$1,800 from UOB to OCBC via FAST. This ensures I meet the salary credit requirement and the average daily balance increase of $500.

Additionally, starting from the second month, I can transfer S$1,300 elsewhere to seek better returns, focusing on making the most of my money without unnecessary spending just to chase the additional 0.6%. (Spend category)

Conclusion

By strategically managing your salary credits and transfers across DBS, UOB, and OCBC, you can significantly enhance your interest earnings. This method not only maximizes your savings but also ensures your money is working harder for you.